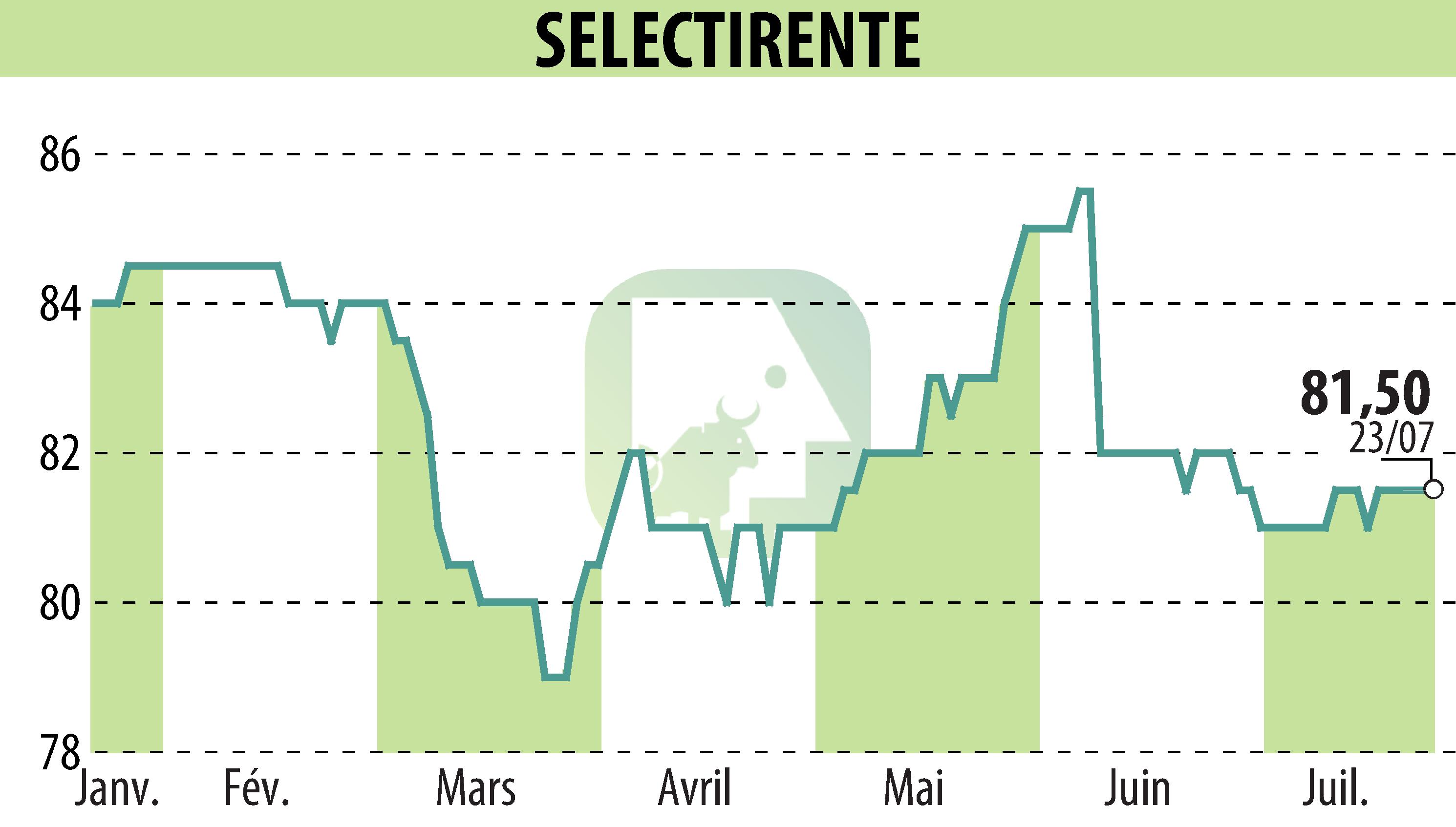

on SELECTIRENTE (EPA:SELER)

SELECTIRENTE: Solid Results in the First Half of 2025

SELECTIRENTE has unveiled its results for the first half of 2025, marked by strong momentum. The company made acquisitions totaling €2.3 million and invested €8.9 million. On the disposal side, assets were sold for €12 million, generating a capital gain of €6.6 million. The portfolio, now valued at €578 million, shows an increase of 1.5% on a like-for-like basis.

Operating performance was solid, with rents increasing by 3.9% on a like-for-like basis, driven by active rental management. The financial occupancy rate reached 95.9% in the second quarter. IFRS net income rose significantly to €18.6 million, although net current cash flow declined by 12%.

The financial structure remains robust, with a debt-to-equity ratio of 34.8% and cash of €6.1 million. SELECTIRENTE continues to invest, with €10.3 million in additional acquisitions already committed after the end of this half-year.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SELECTIRENTE news