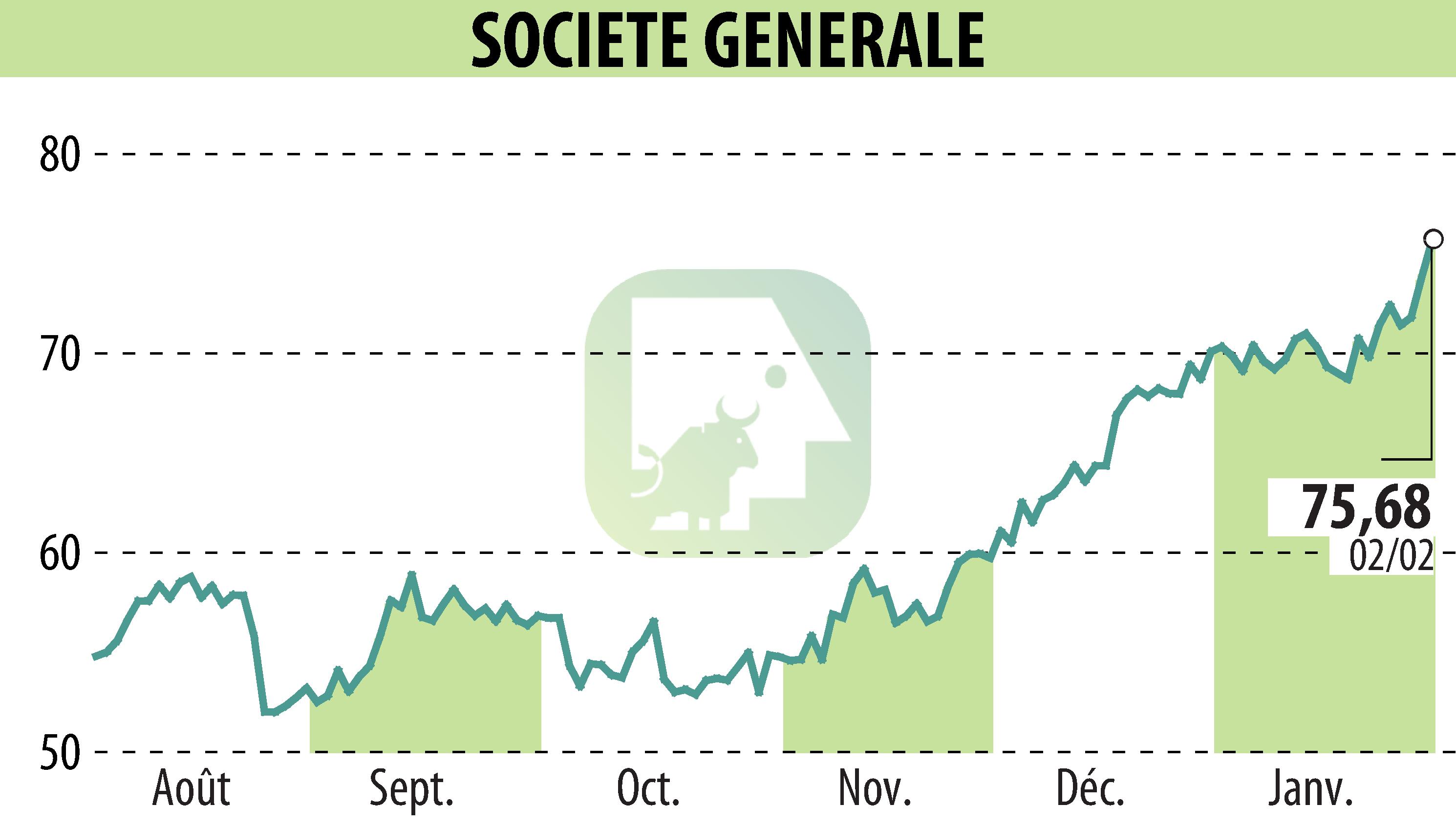

on SOCIETE GENERALE (EPA:GLE)

Societe Generale Nears Completion of EUR 1 Billion Share Buy-Back

Societe Generale announced that by January 30, 2026, it had repurchased 1.9% of its capital. This milestone reflects the bank's progression in completing 95.2% of its EUR 1 billion share buy-back program. These transactions happened between January 22 and January 30, 2026.

On January 26, they acquired shares on various markets, including XPAR, CEUX, TQEX, and AQEU, with the highest daily volume of 303,444 shares at a price of 71.0196 euros on XPAR. Similarly, on January 28, purchases included 166,690 shares at 71.5669 euros on XPAR. The final day of activity saw 154,900 shares bought at 73.1030 euros on XPAR.

The buy-back plan, initiated on November 17, 2025, represents a significant step in Societe Generale’s capital management strategy, enhancing shareholder value.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SOCIETE GENERALE news