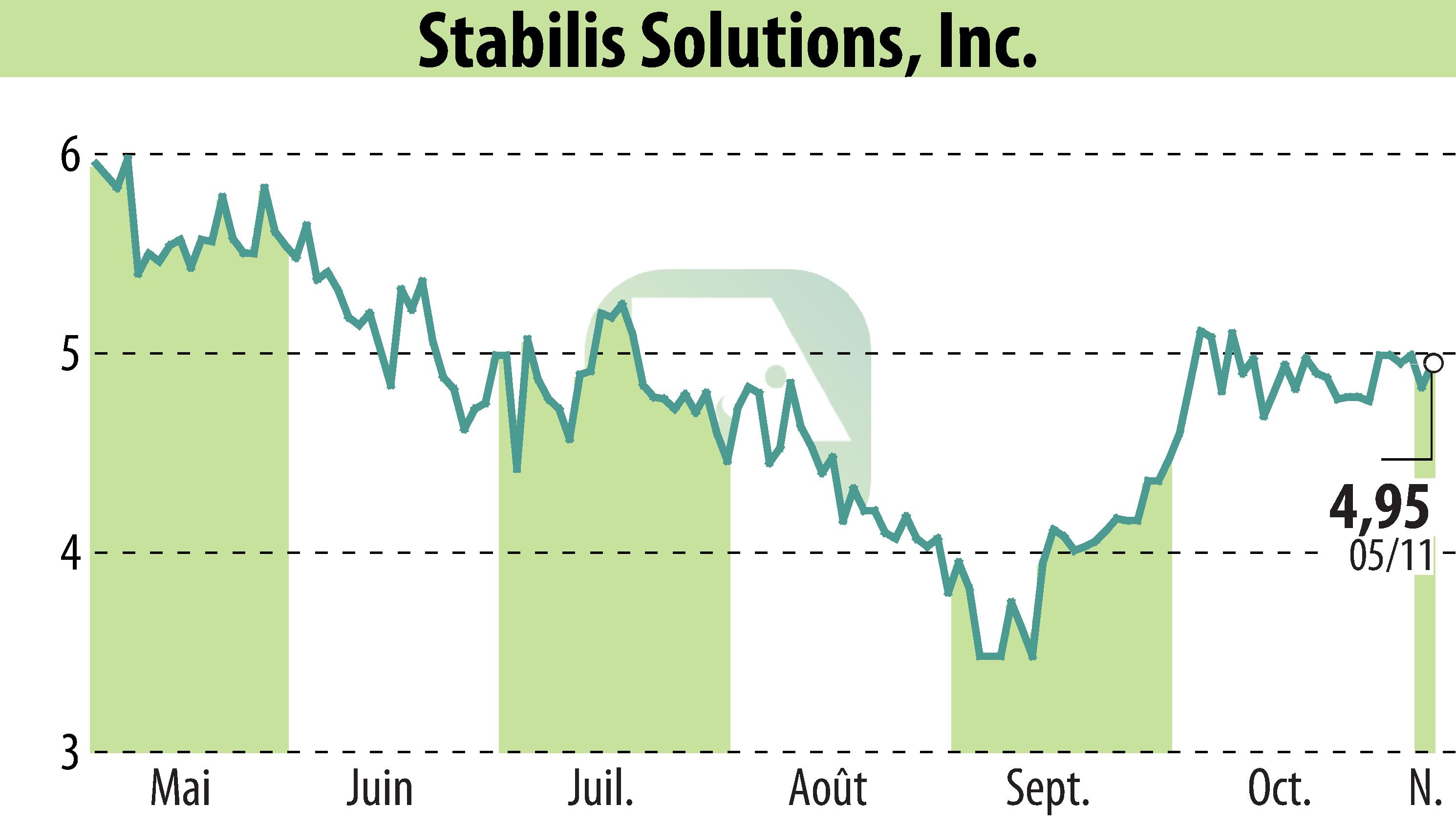

on Stabilis Solutions (NASDAQ:SLNG)

Stabilis Solutions Reports Strong Q3 2025 Financial Results

Stabilis Solutions, a clean energy provider, announced its third-quarter 2025 financial results, showing a revenue increase to $20.3 million, up by 15.3% year-over-year. The company reported a net income of $1.1 million and an adjusted EBITDA of $2.9 million, indicating a $0.3 million rise compared to the previous year. Operational cash flow stood at $2.4 million, with $10.3 million in cash reserves and $5.2 million available under credit agreements.

Casey Crenshaw, Executive Chairman and Interim CEO, highlighted robust execution and market demand, especially in marine, aerospace, and power generation sectors. Additionally, Stabilis announced plans for a new liquefaction facility in Galveston, Texas, aimed at expanding LNG production capacity, supported by a 10-year bunkering agreement with a global operator. Financing discussions for this project are underway, with a decision expected in early 2026.

As Stabilis progresses with its Galveston initiative, CFO Andy Puhala emphasized the company's solid financial footing, underpinned by strong cash flows and strategic capital allocation.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Stabilis Solutions news