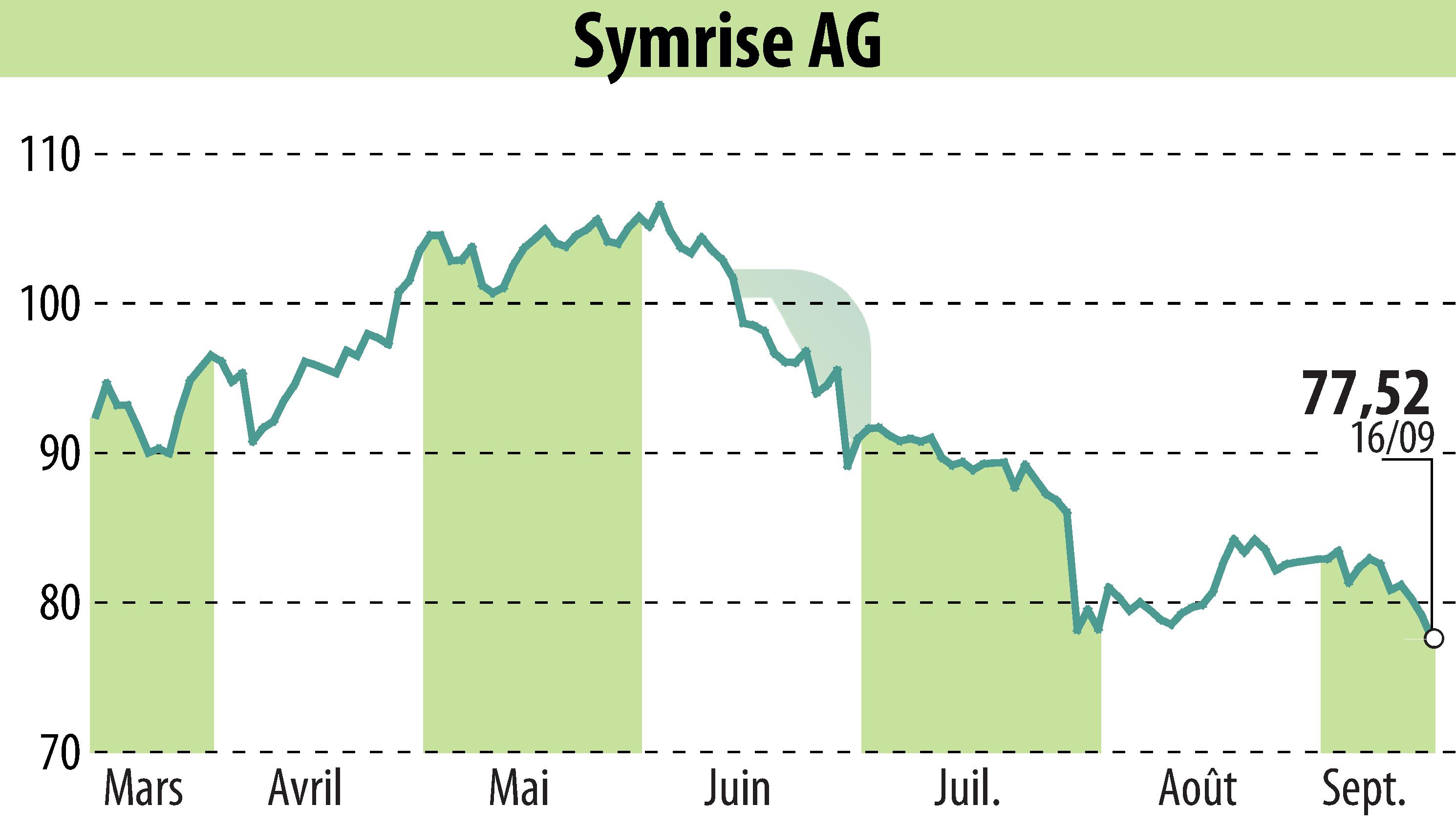

on Symrise AG (ETR:SY1)

Symrise Secures €800 Million Bond Amid Strong Demand

Symrise AG, a prominent global supplier in the fragrance and flavor sector, has successfully placed a €800 million bond in the European debt capital market. The bond's issuance was met with notable enthusiasm, with multiple oversubscriptions, highlighting investor trust in Symrise's strategic direction and financial stability.

The bond features a seven-year maturity and a 3.25% coupon rate. It has been assigned a Baa1 rating with a stable outlook by Moody’s. Proceeds from this bond aim primarily at refinancing upcoming debt maturities by autumn 2025.

The issuance, backed by a syndicate of banks including Banco Santander, Commerzbank, Deutsche Bank, and Société Générale, will be traded on the Luxembourg Stock Exchange. This move solidifies Symrise's robust financing framework, further supporting their sustainable business model.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Symrise AG news