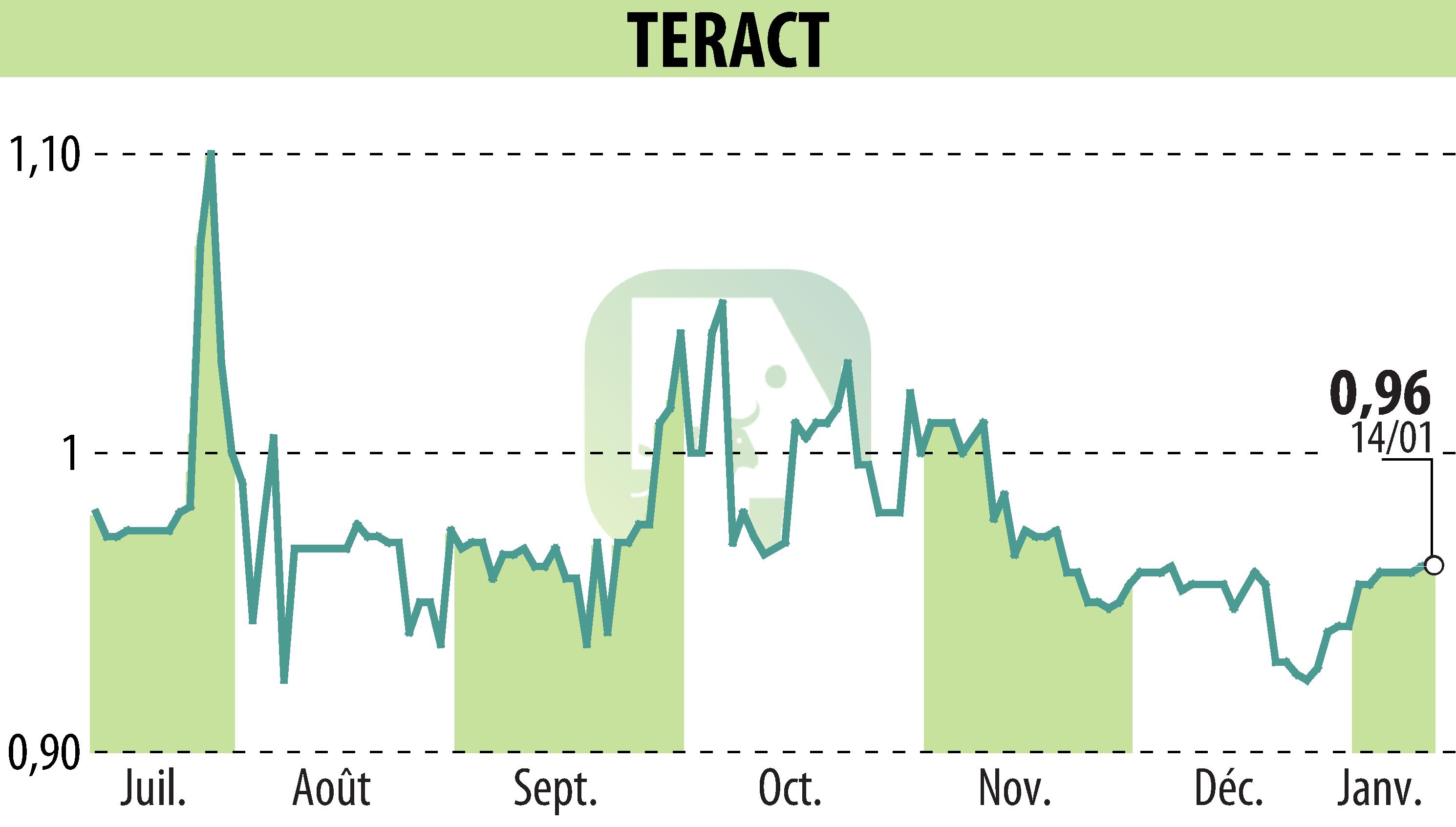

on TERACT (EPA:TRACT)

InVivo Group Announces Buy-Out and Squeeze-Out of TERACT Shares

On January 15, 2026, InVivo Group and the founders announced their intention to file a public buy-out offer followed by a squeeze-out of TERACT shares. This move aims to refocus TERACT on its core businesses, shifting towards a franchise-based model. InVivo anticipates that the buy-out will accelerate strategic transformation and enhance long-term growth.

Originally formed in 2022, TERACT merged the activities of 2MX Organic and InVivo retail. Despite initial focus on sustainable consumption, this priority has shifted. Consequently, the company's shareholding structure will be adapted. InVivo plans to acquire complete TERACT ownership, stabilizing shareholder base and improving operational efficiency.

In collaboration with the founders, holding a significant majority of shares and BSAR B, InVivo will implement a buy-out at 3.12 euros per share. Regulatory approvals are pending, and trading in TERACT shares resumes January 16, 2026.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TERACT news