on TERACT (EPA:TRACT)

TERACT Reports Revenue Decline in H1 2025-2026 Amid Strategic Shifts

TERACT's revenue for H1 2025-2026 is reported at €361.9 million, a decrease of 7.1% on a reported basis and 3.3% like-for-like compared to the same period the previous year. The drop is linked to the franchising of stores against a sluggish economic backdrop. The Garden Centre/Pet Retail sector saw a revenue fall to €294.2 million, primarily due to the franchising of 38 Gamm vert stores. In Food Retail, revenue declined to €67.6 million, influenced by the sale of Bio&Co completed in October 2025.

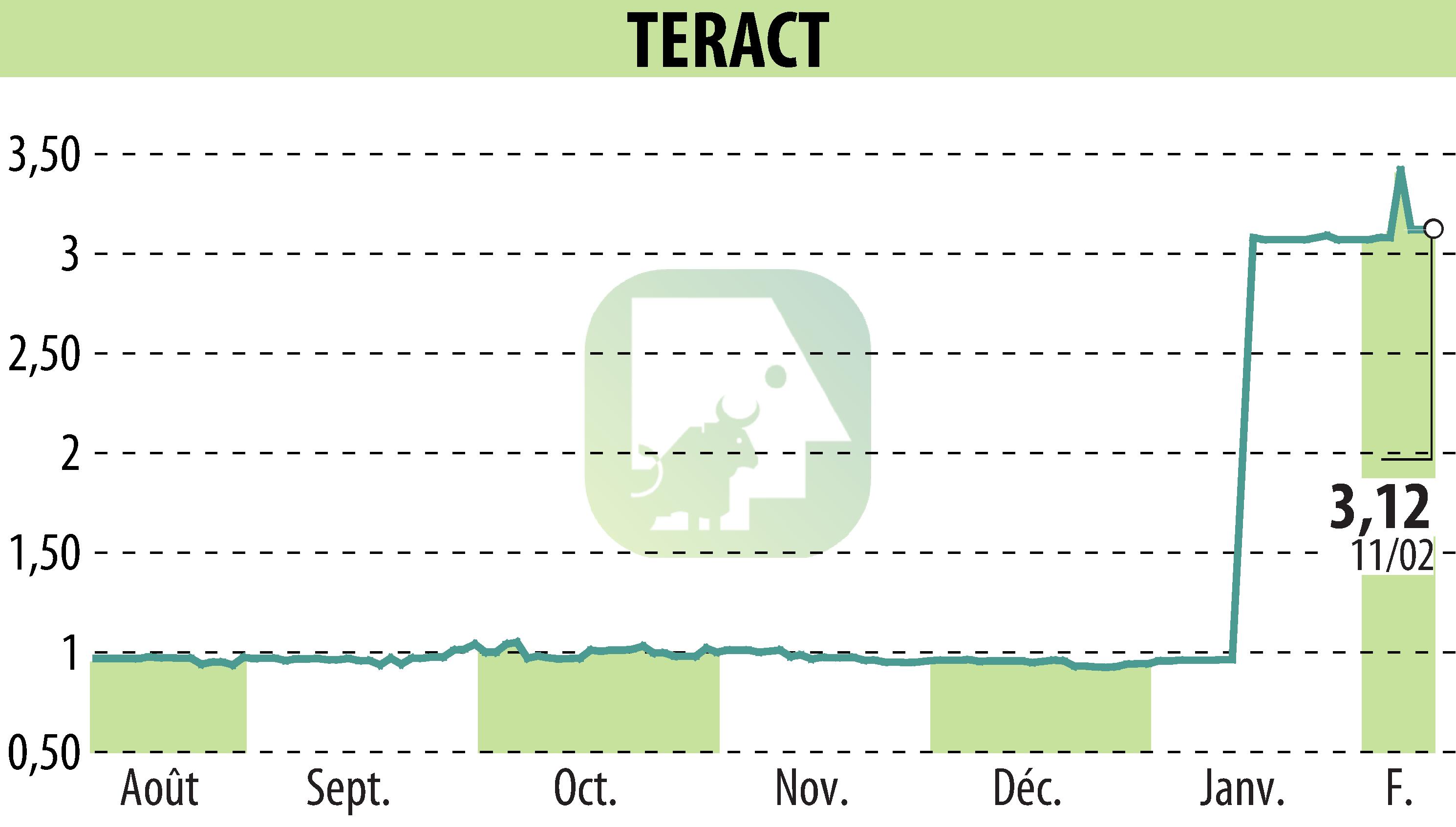

Additionally, InVivo Group, in concert with TERACT's founders, has filed for a public buy-out followed by a squeeze-out of TERACT shares. This move aims to streamline strategic direction and stabilize the shareholder base. Despite the decline in revenue, TERACT continues to advance its own brand strategy and expand its e-commerce presence.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TERACT news