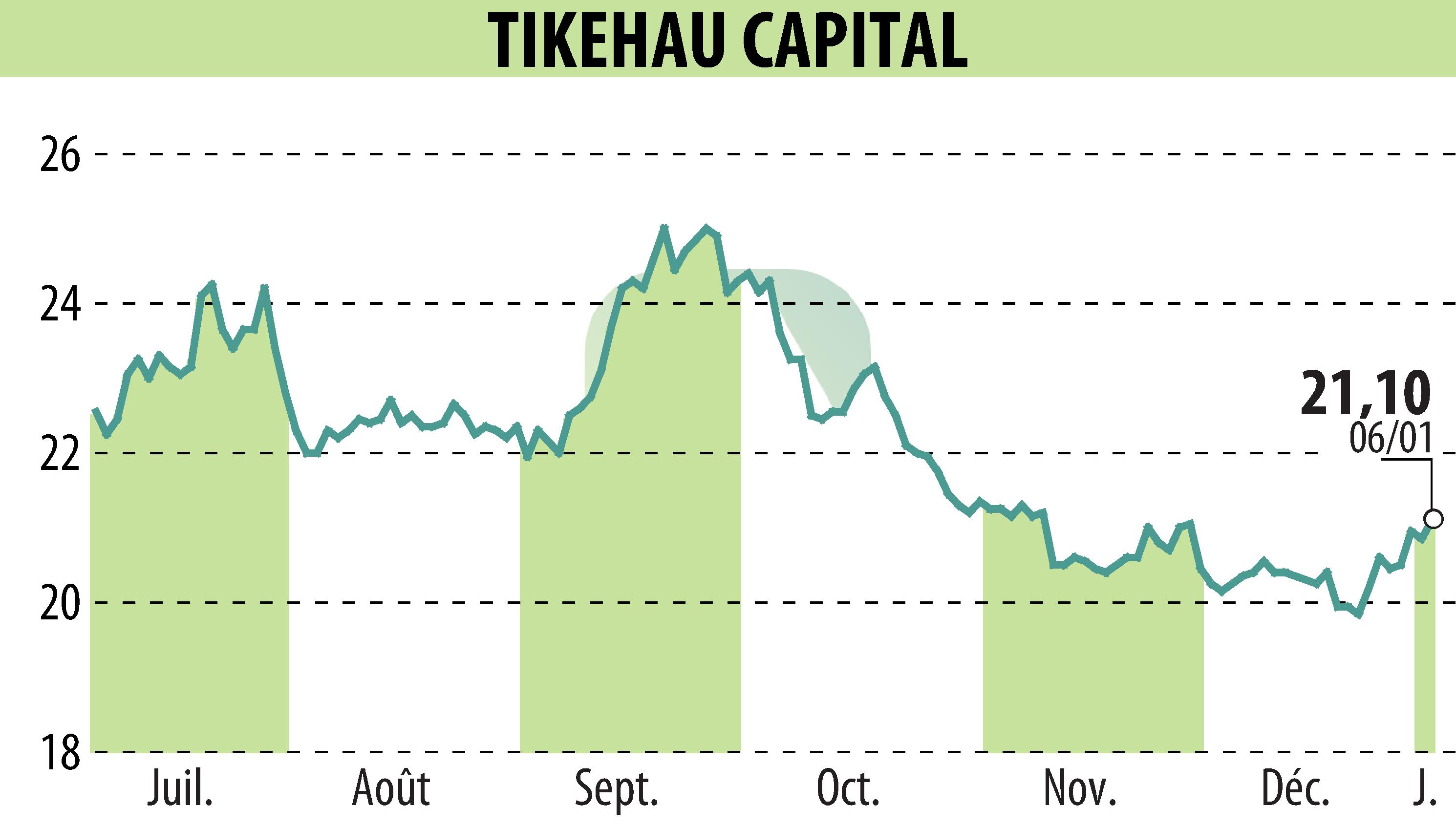

on TIKEHAU CAPITAL (EPA:TKO)

Half-Year Report on Tikehau Capital's Liquidity Contract

As of December 31, 2024, Tikehau Capital's liquidity account, managed by Rothschild Martin Maurel, holds 35,500 shares and 1,130,657 euros in cash. This is part of the liquidity contract. During the second semester of 2024, there were 4,493 buy transactions with a volume of 364,514 shares, worth 8,024,918 euros, and 3,782 sell transactions with a volume of 355,414 shares, totaling 7,847,606 euros.

In comparison, the previous semester saw 3,628 buy transactions involving 337,347 shares for 7,096,330 euros, and 3,659 sell transactions totaling 342,630 shares for 7,240,321 euros. Initially, on January 24, 2022, the liquidity account included 15,000 shares and 1,646,000 euros. The agreement follows AMF Decision No. 2021-01, ensuring market liquidity practices.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TIKEHAU CAPITAL news