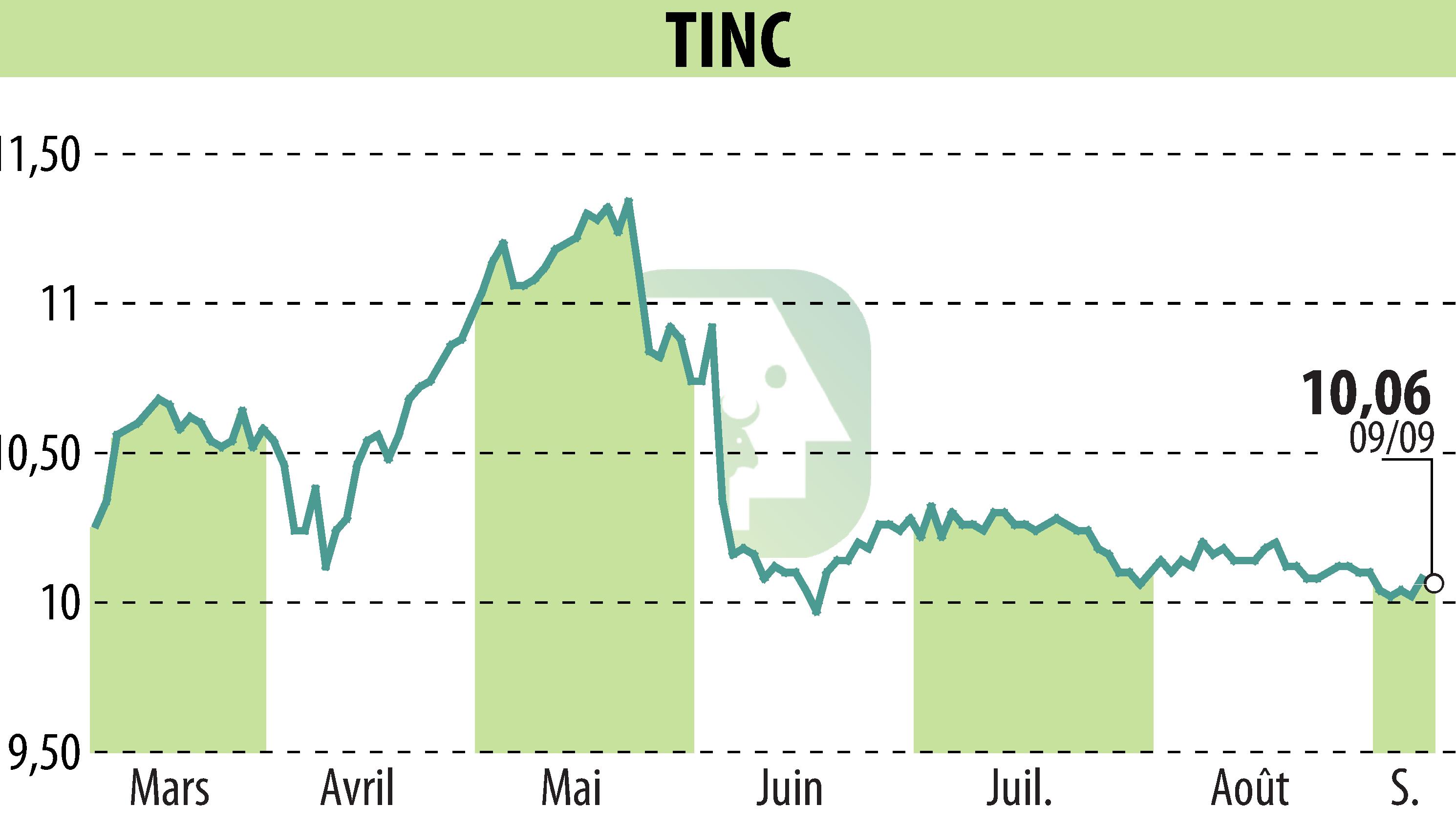

on TINC (EBR:TINC)

TINC's Strong Interim Results and Ambitious Growth Strategy

TINC reported robust interim financial results and is advancing its strategy to double its investment portfolio. The company invested €160 million over the last six months, focusing on diversifying into higher yielding corporate infrastructure. This investment momentum fully utilizes the €113 million generated from the June rights issue. CEO Manu Vandenbulcke highlighted a €34 million net debt, reflecting strategic optimization of the balance sheet, aimed at boosting shareholder returns with a proposed dividend of €0.59 per share.

Chairman Philip Maeyaert emphasized the importance of the recent capital increase of €113 million, indicating shareholders' trust. TINC's portfolio now includes 32 participations across four countries with a fair value of €649.3 million, marking a 26.8% increase compared to December 2024. The reporting period saw commitments of €64.9 million to new investments, such as a €61.3 million commitment to Mufasa in Vlissingen.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TINC news