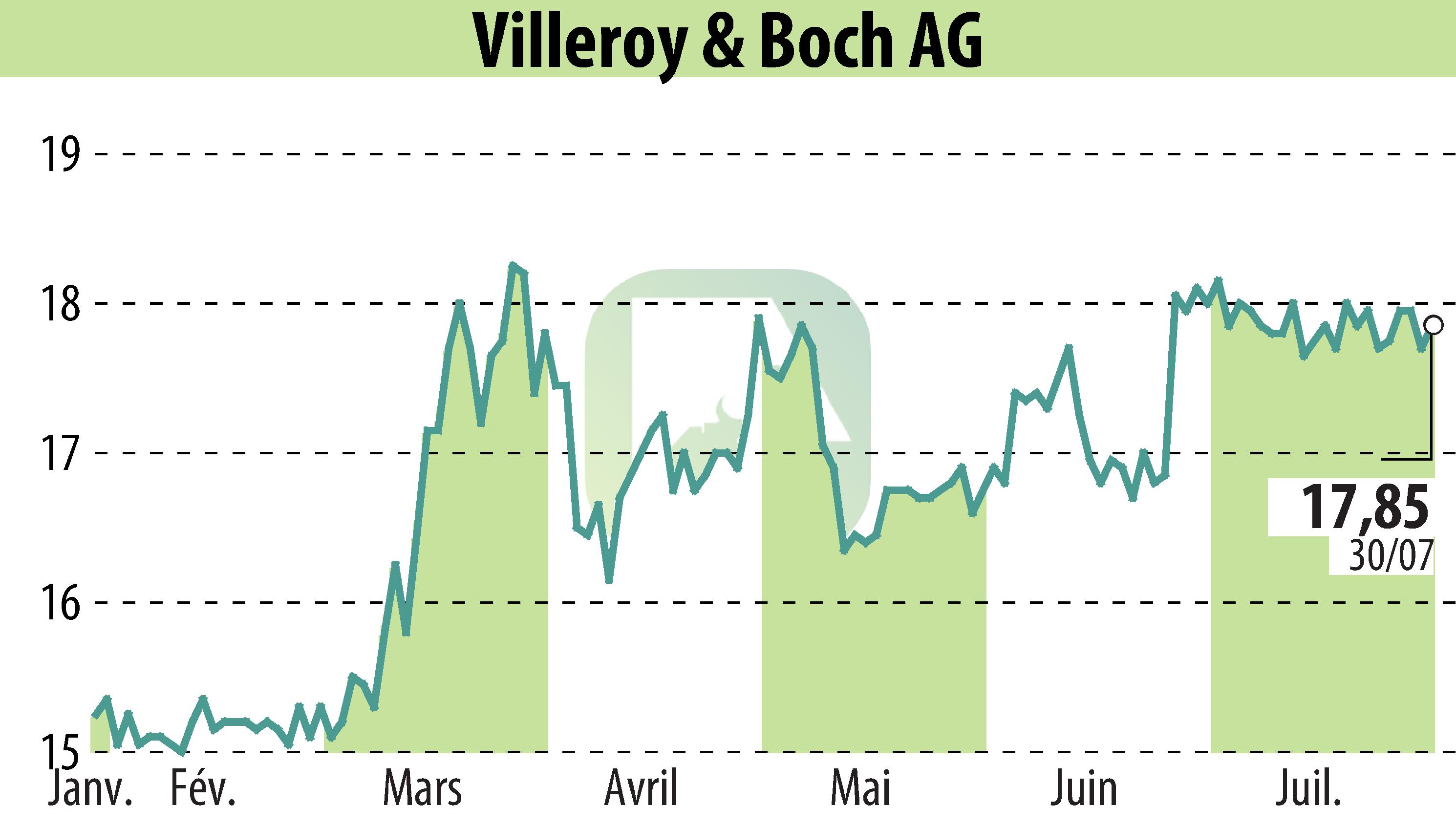

on Villeroy & Boch AG (ETR:VIB3)

Villeroy & Boch Reports Strong Growth Amid Strategic Realignment

Villeroy & Boch AG has announced a 12.1% increase in revenue, reaching €725.8 million, for the first half of 2025. This growth is primarily due to strategic acquisitions, including that of Ideal Standard, and increased international operations, notably in the EMEA region. The company's operating result rose by 3.2% to €47.8 million, with Group EBIT significantly improving to €38.5 million.

The Bathroom & Wellness division experienced a 15.7% revenue increase to €594.0 million, driven by advancements in the fittings business and the EMEA area. The Dining & Lifestyle division maintained stability, generating €130.4 million, with notable progress in project business and retail partnerships.

Despite a challenging global economic environment, Villeroy & Boch continues to emphasize its strategic focus on core brands and business efficiency, particularly following the sale of its Gustavsberg and Vatette brands. The company forecasts modest revenue growth and stable EBIT for the full year 2025.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Villeroy & Boch AG news