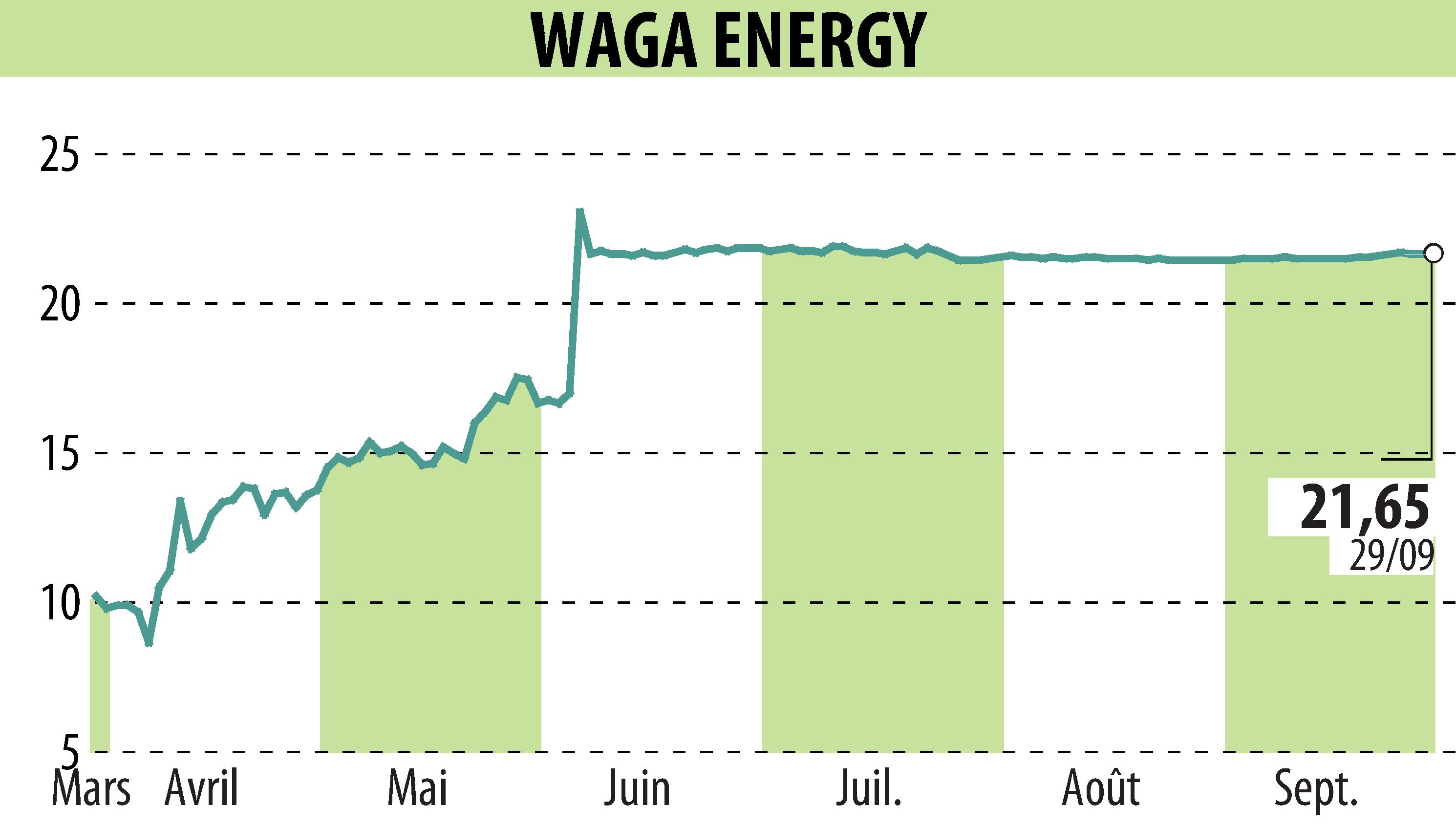

on Waga Energy (EPA:WAGA)

Waga Energy Reports 39% Growth in RNG Revenue for H1 2025

Waga Energy, a leader in Renewable Natural Gas (RNG) production, announced a YoY revenue increase of 39% for the first half of 2025, reaching € 27.4 million. This growth was driven by increased RNG production despite a projected decline in EPC revenues. The company aims to achieve EBITDA breakeven by the end of 2025, having improved its EBITDA by € 2.3 million to -€ 0.2 million during this period.

Operationally, Waga Energy injected 326 GWh of RNG, avoiding 80,500 tons of CO₂ emissions and maintaining a 95% uptime across their portfolio. The company is focusing on converting a pipeline of projects into signed contracts, particularly in the US, with € 59 million in Capex investments, more than double compared to H1 2024.

With 31 production units in operation and 19 under construction, Waga maintains a strong liquidity position with € 55 million in cash and € 94 million available in undrawn debt. The firm is poised to reach significant growth targets despite market uncertainties.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Waga Energy news