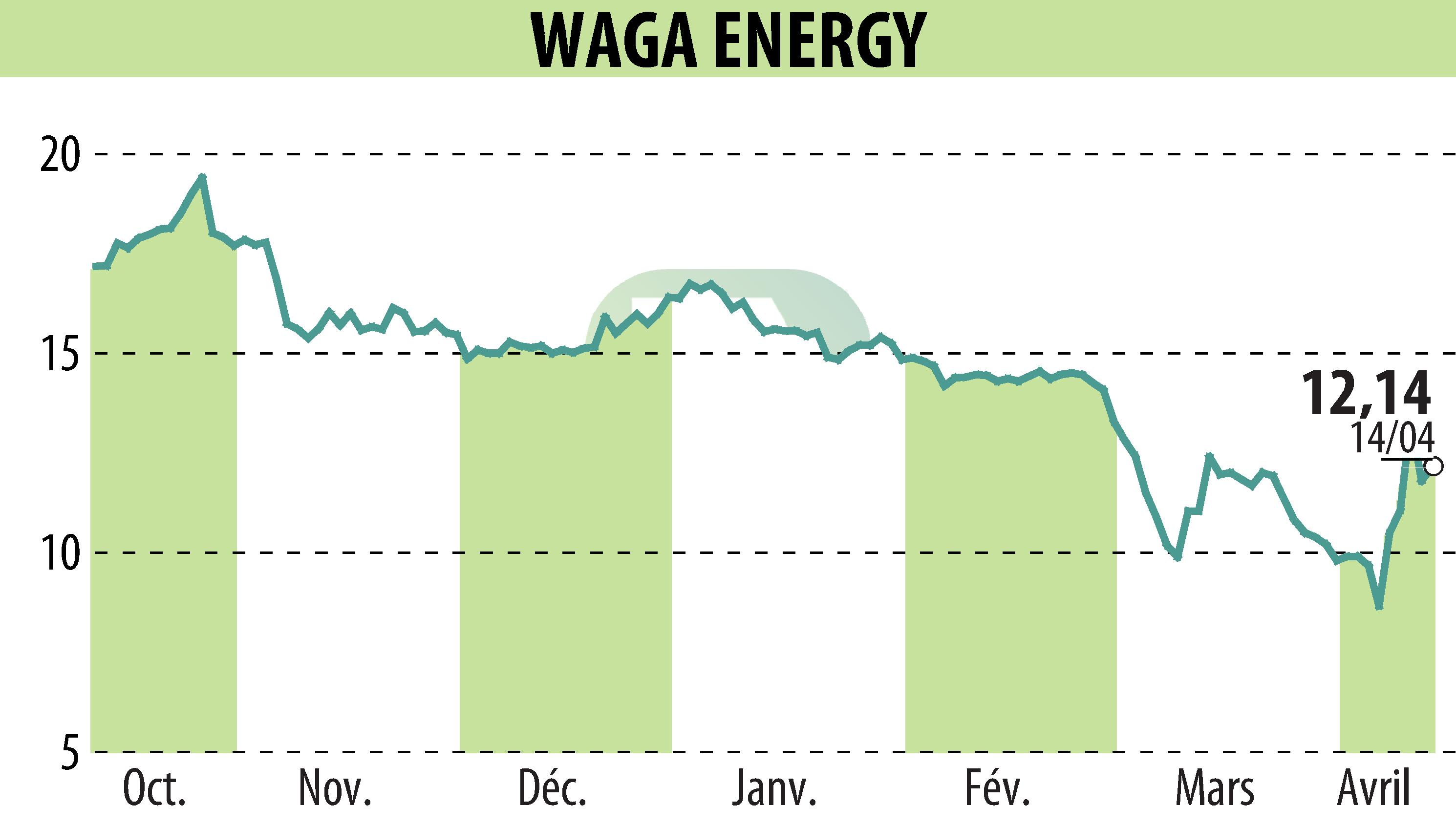

on Waga Energy (EPA:WAGA)

Waga Energy Targets EBITDA Breakeven by 2025 Amid Strong US Growth

Waga Energy has reinforced its financial outlook, aiming for EBITDA breakeven by 2025, bolstered by robust US momentum and improved 2024 EBITDA performance. In 2024, Waga reported a full-year EBITDA of -€2.6 million, improving by €2.2 million year over year. Revenue surged to €55.7 million, a 67% increase, primarily due to biomethane production revenue, boosting by 81%.

The company's commercial efforts flourished, announcing 10 new contracts in 2024 and three additional in 2025, largely driven by the US market. Waga Energy's strategic expansion also saw ten new projects launched in 2024, alongside a 72% rise in renewable natural gas (RNG) production, significantly reducing CO2 emissions.

Waga sustains a solid financial stance with liquidity at €182 million, including €68 million in cash, underlining its fiscal resilience. This financial strength is expected to aid their expansion into markets like Latin America, supported by their unparalleled execution capabilities in an uncertain economic climate.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Waga Energy news