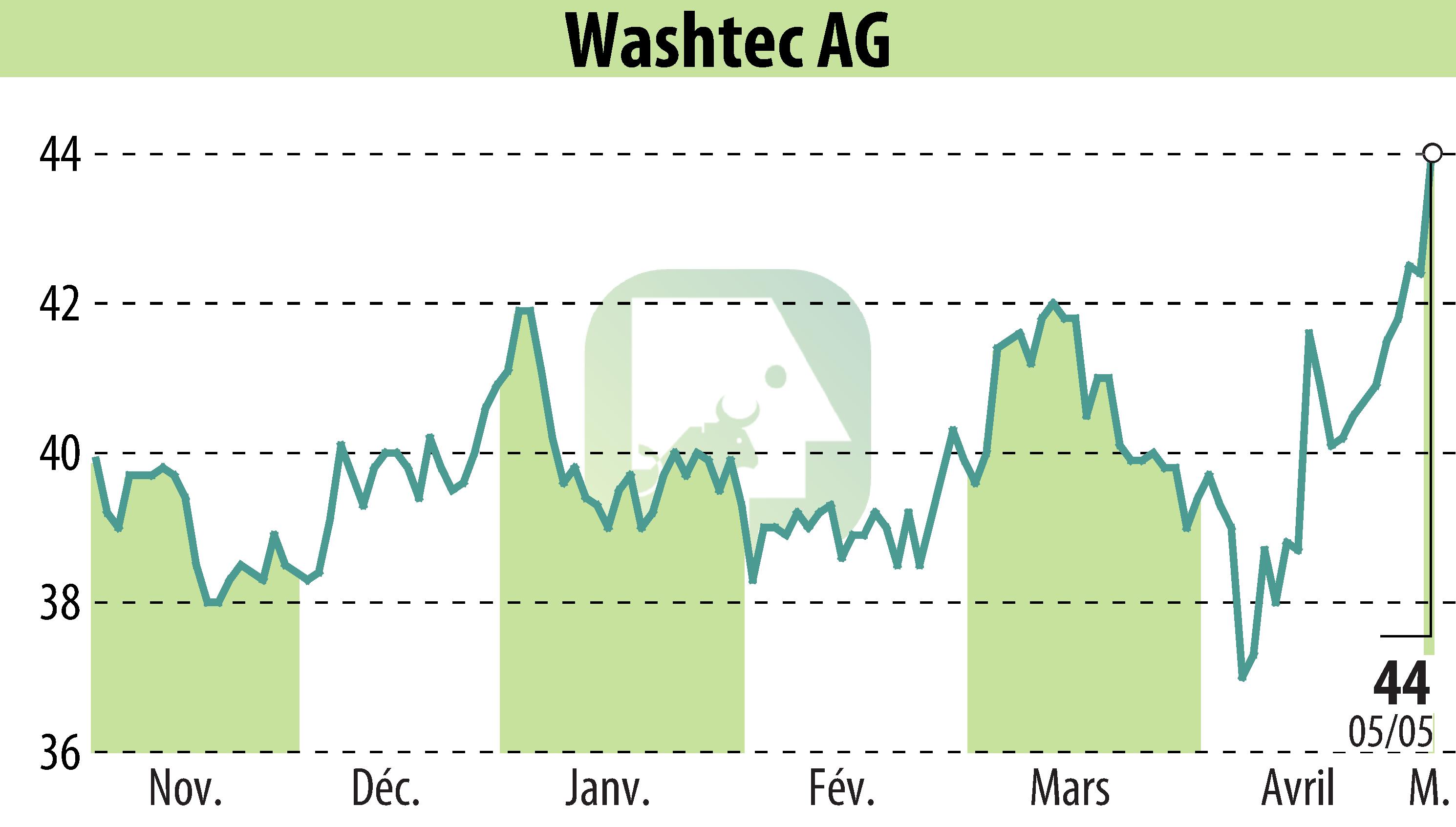

on WashTec AG (ETR:WSU)

WashTec AG Reports 7.9% Revenue Growth Amidst EBIT Challenges

WashTec AG announced a 7.9% increase in revenue, reaching €108.8 million in the first quarter of 2025, compared to €100.8 million a year earlier. This growth is attributed mainly to increased revenue in Europe and other regions, despite steady sales in North America due to reduced equipment sales to key accounts.

The company's EBIT slightly decreased to €4.9 million from €5.1 million in the previous year, with the EBIT margin declining from 5.1% to 4.5%. This decline was largely due to reduced revenues in North America.

WashTec's free cash flow saw a significant rise to €16.5 million, driven by improvements in net operating working capital. Equipment orders also rose across all segments, contributing to an increased order backlog.

WashTec maintains its fiscal 2025 guidance, anticipating minimal impact from current global trade conflicts on carwash market investments.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WashTec AG news