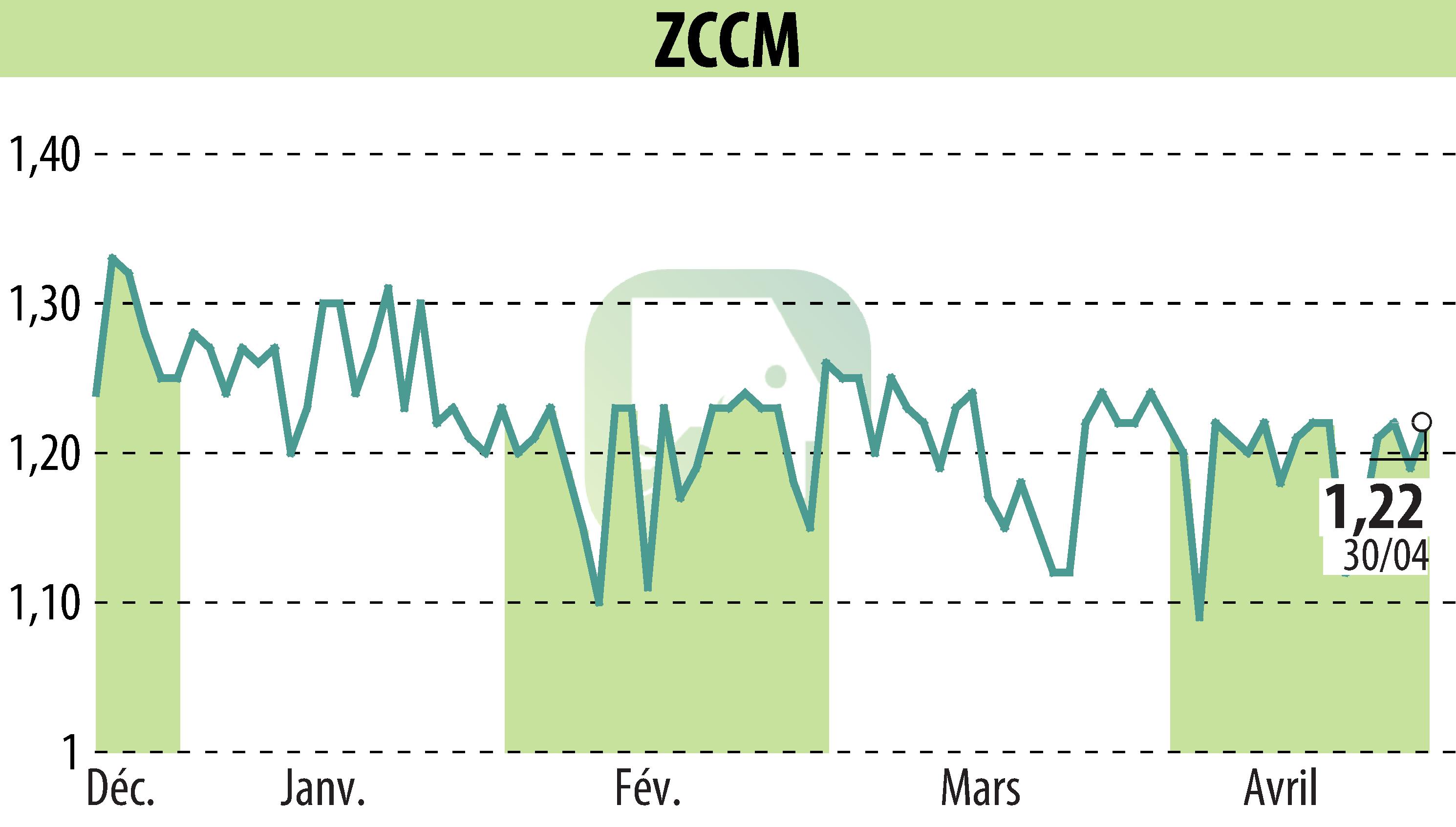

on ZCCM (EPA:MLZAM)

ZCCM-IH Posts Strong 2024 Financial Results Driven by Strategic Partnerships

ZCCM Investments Holdings Plc announced an impressive financial turnaround for 2024, with a net profit of ZMW 39.85 billion (US$ 1.52 billion), reversing a ZMW 4.08 billion loss in 2023. This improvement was largely due to the Mopani Strategic Equity Partner (SEP) Transaction, which contributed a one-off net gain of ZMW 32.06 billion.

The transaction also led to a reduction in legacy debt by US$ 1.71 billion and a reclassification of Mopani as an associate, diluting ZCCM-IH's interest to 49%. Despite a slight decline in total assets to ZMW 57.29 billion from ZMW 58.46 billion in 2023, group equity improved to ZMW 52.26 billion.

ZCCM-IH's future focus includes maximising investee returns, developing green projects, and enhancing its ESG impact across Zambia.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ZCCM news